*This post contains affiliate links. That means I receive a small commission that could help me on my debt-free journey —at no extra cost to you—if you make a purchase using the links.

Several conversations over the past few weeks have made me take pause and reconsider my debt payoff strategy. I dove headfirst into debt payoff at the expense of saving a full emergency fund and, frankly, my peace of mind and protection as well.

The shame! Somehow I subconsciously believed that I’d be fine. Pay off debt! Pay off debt! Go forth and conquer!

But what if I lose my job? What if I have to fly from China to the States tomorrow for a family emergency? What if I need to pay for a surgery?

As of Sept. 7, 2018, I have less than $400 in savings in the States. Soooo very un-wise! (Un-wise sounds much better than stupid, right?) I got too excited about paying off debt and didn’t replenish my starter savings a.k.a. emergency fund when I dipped into it in December 2017.

“Paid In Full” be calling me, man! It just keeps calling me. These three words give me the same giddy feeling I get when someone places an unexpected gift in my hands—pure, unadulterated joy.

Now I have to switch gears. If I overpay FedLoan Surviving before resuscitating my savings, I can’t call ‘em up and ask for it back. It’s time to put myself first.

And if you don’t have an emergency fund, then it’s time to put yourself first, too.

What is an emergency fund?

An emergency fund is a buffer between you and unexpected things that come your way. It is usually saved in a liquid account (i.e. savings account or money market account) for relatively easy access.

Let’s not think only in terms of an emergency but in terms of an opportunity to solve a problem or take advantage of something awesome with your savings.

Years ago, my cousin in my head, Patrice C. Washington, suggested calling it an Opportunity Fund. Words matter. If you keep calling your savings an Emergency Fund or Rainy Day Fund, then that’s what you’ll attract—emergencies and rainy days. Who wants to save for that?! Opportunity Fund or Sunny Day Fund sounds so much better.

Full disclosure: I only use emergency fund for SEO purposes. I agree with Patrice.

Why do I need an emergency fund?

- unexpected medical bills

- larger-than-normal house or car repairs

- job loss or reduced hours

- peace of mind

To put it simply, life happens. If faced with a $400 unexpected expense, about 4 out of 10 American adults could NOT pay for it in cash, according to a Federal Reserve report released in May 2018. They’d have to sell something or borrow money.

Let’s be honest, we don’t want to be or have one of our loved ones be 1 of the 4 people in dire straits.

When should I use my emergency fund?

Beyonce concert tickets. Nope!

A sale on cashmere sweaters. No, again.

The car needs an oil change. Nah, bruh.

That’s now how this works. That’s not how any of this works! Emergency funds are for unexpected expenses.

Here’s a tip: Write a list of reasons you will NOT use your emergency fund. This will help you get clear about what constitutes an emergency.

Budget and create separate sinking funds for fun outings, clothes and regular car maintenance. Sinking funds are savings you add to on a regular basis to pay for an irregular yet expected expense (i.e. annual car insurance premium, Christmas gift shopping, oil changes).

To create a sinking fund, first set up a savings goal. Then divide that number by the number of pay periods or months between the present day and the deadline. Finally, add that amount into a savings account separate from your checking account each pay period or month and allow it to grow unbothered. For example, if it’s January and you want to have $500 for Christmas gift shopping, then save $45.50 each month from January to November (11 months).

When do I need to save an emergency fund? Before paying off debt or after paying off debt?

You need to save money when you have money. So simple, yet so true. The time to save is NOW! Gather the crops in the summer and fall so you’ll be ready for winter.

If you’re a Dave Ramsey enthusiast, then you might think that you only need $1,000 before you start tackling non-mortgage debt. After you pay off that debt, then he suggests savings 3 to 6 months’ worth of expenses.

But let’s think about this for a moment. What if you have an emergency or an opportunity to solve a problem quickly with money that’s over $1,000? You’d have to get back into debt or sell something to pay the remainder unless you can work out a payment plan. Remember those 4 people. Do you want to be like them?

So consider saving a large emergency fund before tackling debt. Also, consider your interest rates. If you have a credit card with 29% interest, consider saving $1,000 for emergencies first because you might only earn up to 1.85% interest on that. Then crush that credit card balance and get back to saving before tackling low interest rate debts (i.e. car loans at 3%, student loans at 5%, etc.).

I still have $40,000 left to pay in student loans. Believe me, I feel the urge to pay them off, but I’m pressing pause to build a large amount of savings.

How much should I save in an emergency fund?

I work and live in China. My flight back to the States for an unexpected trip would cost about $1,000 alone. So is $1,000 in an emergency fund enough? I think not! Sorry, not sorry, Dave.

The amount you save depends on your personal goals and comfort with risk. Many experts say 3 to 6 months’ worth of actual expenses—not numbers you pull out of the sky. I plan to save 3 months’ worth of expenses before I start making extra debt payments again. Check out my big savings goal and how I plan to achieve it.

Here are 10 questions to ask when deciding how much you need to save:

- How much is my take-home income a month?

- How much are my actual monthly expenses?

- Will I save several months’ worth of take-home income or expenses?

- Will I save the actual number or a bare-bones number of expenses (just enough to eat, put a roof over my head and gas in my car)? Consider if living off your bare-bones budget without fun stuff will make you happy.

- How many months’ worth of expenses do I want to save? 1? 3? 6?

- If I lost my job right now, how many months would it take me to get a job with the same or more pay? Longer than expected, says Marc Miller of CareerPivot.com.

- Should I base my emergency fund on 1 income or 2 incomes?

- How much are my medical copays and deductibles? Do I want to include money for that in the emergency fund?

- How much is my car insurance deductible? Do I want to save that amount on top of X months’ of expenses?

- Do people outside of my household depend on my financial contributions? How much would they need?

How can I build an emergency fund?

First of all, create a clear goal with an inspired reason why you want to achieve it, a deadline, action steps and solutions to possible obstacles.

As of Dec. 31, 2019, I have $12,000 in savings because I set up a savings account at a bank that doesn’t house my checking account, set up automatic deposits each paycheck for $500, went without some wants and prioritized savings in my budget.

Why? I want to be able to cover 4 months of my family’s expenses in case we lose our income.

Written or typed? Both.

Shared with: Bae and Instagram friend.

Daily reminder? Yes. On phone and nightstand.

Obstacles? Dipping into the account for wants or other goals.

Solutions? Put money in an account with withdrawal limits at a bank separate from my checking account and rename the savings account “Family Freedom Fund” to remember my “why.”

Make savings a priority in your budget and pay yourself first. If possible, automate savings. Go to your HR staff and have them directly deposit a savings amount ($100 or 5% of your paycheck) into a savings account separate from your money for bills and spending. Or set up an automatic transfer 2-3 days after payday from your checking account into your savings account.

The money for your emergency fund will come from three main activities, as does all money:

- Cutting expenses and saving what you would have spent. This is the easiest thing to do initially. Eat out less. Meal plan and cook at home more. Call all of your bill companies and ask for reductions or enrollment in discounted promotions (think cable or phone companies).

- Earning more money. Get a raise at your current job and save it. Sell plasma or things taking up space around your home. Start a business or get a second job.

- Saving windfalls and bonuses. Birthday and Christmas gifts or unexpected inheritances are fair game.

Where should I save the money?

The money should not be so easy for you to access that you dip into your savings to buy clothes at Target. However, it should be easy enough for you to access when you need it. Do not invest emergency fund money. Rule of thumb: Only invest money you don’t need right away. It’s for the long term.

Wherever you save the emergency fund, make sure the account is FDIC-insured and it’s NOT connected to the checking account or debit card you use for everyday purchases or bills. If your savings account comes with an offer to get a debit card, you can help yourself by doing two things:

- Refusing the debit card so you can’t touch the money easily (brick-and-mortar bank).

- Getting the debit card and immediately putting it away in a safe place (online bank). Keep it out of sight and out of mind (as in, out of your wallet).

Consider these savings vehicles:

- Savings account: Savings accounts earn more money than checking accounts. You can earn up to 2.05% interest in some online savings accounts, which is much higher than brick-and-mortar savings accounts. Online banks use less money for overhead, so they pass savings onto customers. Search for high rates on MaginifyMoney.com or BankRate.com, but don’t get analysis paralysis and harp on interest rates. The point of the emergency fund is to have enough to cover your hide and relatively easy access to it, not to earn an exorbitant amount from interest. My savings earn money in my Capital One 360 account, which has no monthly fees.

- Money market account (MMA): Some money market accounts with online banks are paying high interest rates like savings accounts, however, they usually require a large opening deposit or balance like $5,000 or $10,000. Generally, the higher the balance, the higher the interest rate. So you could start your emergency fund in an online savings accounts and transfer it to an MMA. MMAs offer less access than savings accounts (for example, up to 6 withdrawals and transfers a month) but more access than Certificates of Deposit.

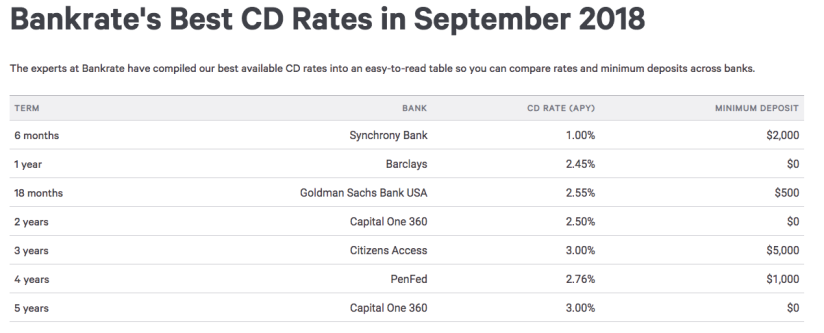

- Certificate of Deposit (CDs): CDs work for money you want to set aside for a long time. You can lock in interest rates for certain terms (3 months to 5 years), but if you withdraw the money before the term ends, then you pay a withdrawal penalty (usually the amount of interest earned over a few months). This could work if you want to set up a strict barrier between your fingertips and some of your emergency fund money. Generally, the longer the term, the higher the interest rate. Choosing the shortest term that gives you the best rate is the recommended strategy, BankRate.com suggests.

Please do your due diligence by understanding terms and conditions for the savings vehicle you choose. Below you’ll find some of the best accounts chosen from Bank Rate in September 2018.

What should I do if I dip into my emergency fund?

First of all, don’t get hung up on the fact that you spent money you worked hard to save. Be elated that you could turn an emergency into a minor inconvenience because you had the money to quickly solve the problem.

Then stop making extra payments on debt or other non-immediate money goals. Go back to making minimum payments until you replenish the emergency fund.

Create another goal to replenish your savings again by briefly cutting expenses, earning more money or savings windfalls.

After that, go back to crushing debt or working toward other goals.

If you dipped into your emergency fund for a non-emergency, then review your budget and spending triggers to figure out how to prevent that happening again. If the emergency fund is connected to your main checking account, then separate it immediately and open up a savings account at another bank to reduce temptation and ease of access.

How can I stay motivated while reaching for my savings goal?

I estimate that it will take 6 months to create my 3-month emergency fund. Half a year seems like such a long time, but this is a worthy goal.

Here’s how to stay motivated on this savings journey:

- Remember your “why.” Keep it on your phone, mirror, debit card or computer screen.

- Name your savings account. When you see “Family Freedom Fund” of “F It Money,” you might be less likely to withdraw $200 for sneakers.

- Create a goal with reasonable numbers. If you can barely save $50 a month, then don’t set a goal to save $10,000 in 3 months.

- Visualize your savings. For each $50 you save, put a chocolate coin in a jar or color in another section on a chart.

- Reward yourself for reaching milestones along the way. Remember to have low-cost rewards that don’t derail you from the main goal.

- Get a trusted accountability partner. If you’re married, then your partner probably already lives with you. Savings a large amount of money can be hard. Don’t do this alone.

KEY TAKEAWAYS

- Consider saving 3 months’ worth of expenses or more before tackling debt.

- Create a clear goal with an inspired reason why you want to achieve it, a deadline, action steps and solutions to possible obstacles.

- Write a list of reasons you will NOT use your emergency fund. This will help you get clear about what constitutes an emergency.

- Budget and create separate sinking funds for non-emergencies and expected expenses—fun outings, clothes, Christmas gift shopping and regular car maintenance.

- Keep your emergency fund separate from the checking account and debit card used for bills and everyday purchases.

- Automate savings as much as possible.

- Devise inexpensive ways to reward yourself when you reach milestones (i.e. saved 25%) to stay motivated on the journey.

Thank you for this post. I follow you on IG, but I’m only now combing through your website. There are so many gems here. Thank you!

LikeLike

Yay! 😊 I’m glad you found useful material on the blog. Thanks so much for reading this post and following me on IG. What gems did you like the most? I’d love to know.

LikeLike